The Importance of CRM for Reverse Mortgage Professionals

Any professional lender will tell you that providing exceptional customer service is key to their long-term success. When it comes to the reverse mortgage process, the customer experience may be even more relevant.

No matter the scale of your operation, keeping constant and accurate communication from start to finish can make a tremendous difference in whether or not you close the deal. That’s why one of the strongest tools available for reverse mortgage professionals is customer relationship management (CRM) software.

By implementing a reverse mortgage broker CRM solution into your business, you can develop more meaningful relationships with your clients and track your progress while increasing profitability.

Are you looking for the best reverse mortgage CRM software? Let’s take a look at what makes a CRM worth your time and money for helping you close more loans.

How Does a CRM Solution Work?

CRMs for mortgage lenders come in a wide range of forms with an equally wide range of features. It’s up to you to determine which of these works best for your needs, but there are certain elements of a CRM that your business should not go without.

The most important CRM features for reverse mortgage professionals include:

- Automatic lead distribution

- Integrated B2B referral tracking

- Auto-populated vendor leads

- Advanced search tools for client databases

- Email sequencing and follow-up

- Compatibility with Loan Origination Software

CRMs for reverse mortgage officers are designed to help them stay ready at all times. They should enable streamlined and automated services, provide pre-built templates for email marketing, display account statuses, and allow lenders to access client data from a single location. Ultimately, a CRM should enable a mortgage professional to be proactive in creating a healthy pipeline from quality leads to closing loans.

Optimized Features for Reverse Mortgage Lenders

Counseling, education, and extensive homework are critical during the reverse mortgage process, and managing such a project can become overwhelming without automation. That’s why the best CRMs offer fully optimized automated pipeline management throughout the lifecycle of both prospective clients and ongoing customer relationships. A CRM must offer tools that help reverse mortgage officers better engage with their clients, manage the flow of inbound leads, and increase their ROI.

Last but not least, a comprehensive CRM solution should be simple – but not for a lack of advanced tools. The truth is that most loan officers will simply ignore CRM suites entirely if they have steep learning curves or aren’t sufficiently user-friendly. If a CRM can offer both elegance and simplicity, reverse mortgage professionals will instantly recognize the benefits of its use.

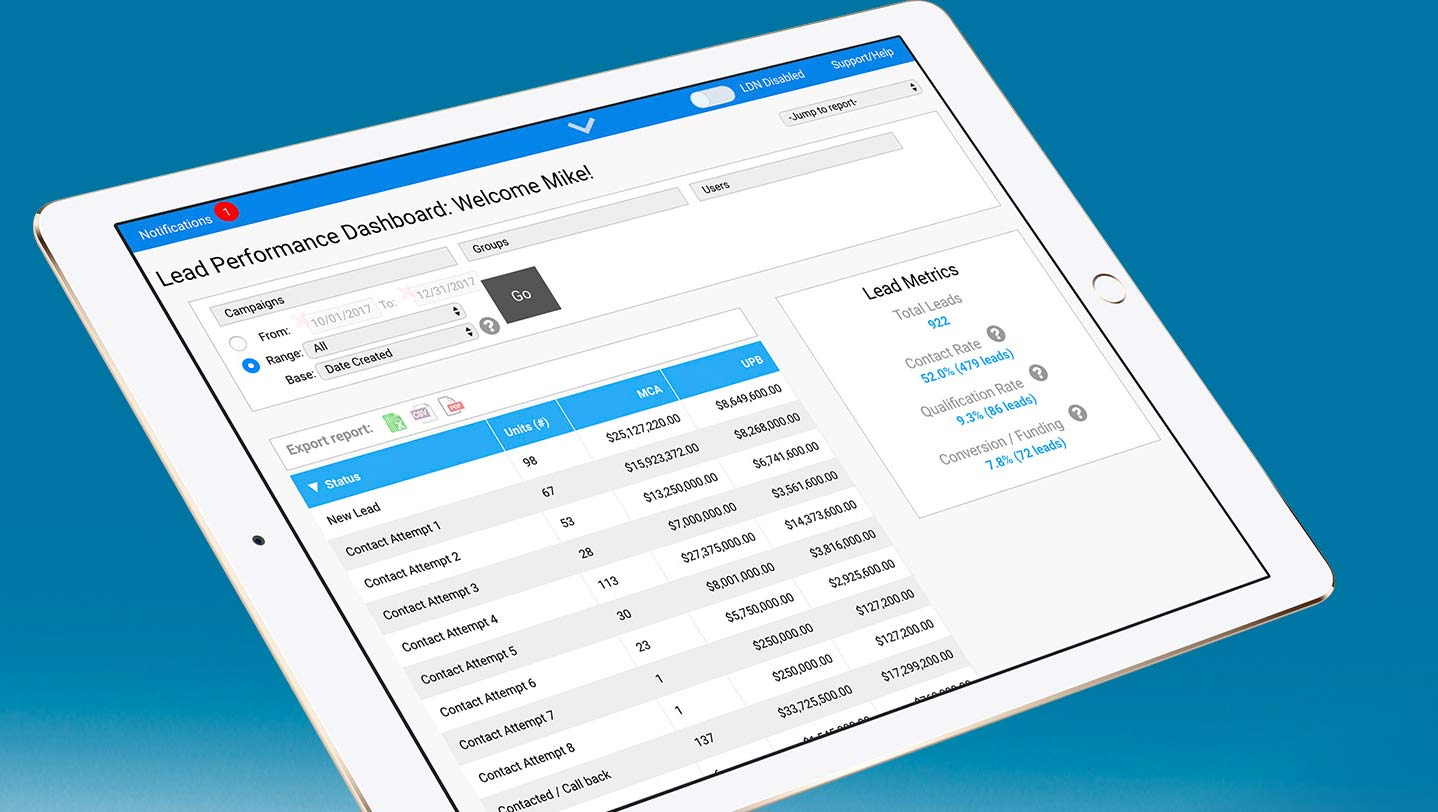

As a web-based technology, Sales Engine is a dynamic CRM solution created specifically for reverse mortgage professionals. By striking a balance between intuitive tools capable of handling the most complex tasks and a beautifully streamlined user interface, Sales Engine is designed to ensure reverse mortgage officers close more deals.

To learn more about how Sales Engine CRM can transform your sales process and ensure you close more loans, schedule a software demo or reach out to a member of our team today.